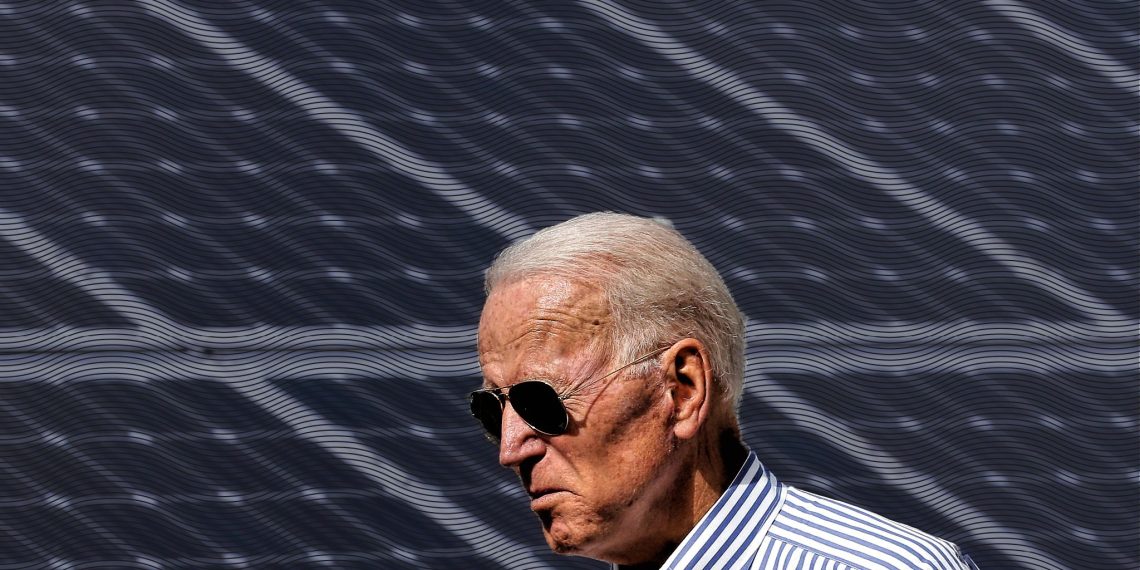

Suprise, Suprise, a Biden Win would most likely be Boon for the Solar Industry

Solar investors will have a lot to be excited about should we see a “Blue Wave” this fall. Biden has suggested

a strategy to leverage $2 trillion in subsidies for sustainable jobs, which would help enable the realization of a 100% clean electricity standard by 2035. If enacted, it is a very ambitious plan which can boost annual solar demand by almost five-fold from current levels during the next eight decades. In reality, our base case assumes that the run rate of solar installations would be greater than 2.5x from the conclusion of Biden’s initial term compared to where solar demand would be in the U.S. if Trump be re-elected for another term. One of the major modifications that could be on the table comprise a potential expansion of the Investment Tax Credit. Others include hints to make direct cover provisions a reality together with revisiting the tariffs that were placed on solar goods manufactured outside the U.S.. In addition, we see a higher likelihood that tax equity funding requirements would improve beneath Biden while he would also likely look to put the U.S. back in the Paris Climate Agreement.

The ITC

We think Democrats – if they win — are more likely to extend the

Investment Tax Credit, which has begun to scale . We

view the ITC since the lifeblood for solar demand in the U.S.. At the national level, the ITC has gone through several cycles of enactment and expiration over the last 30 years. In 2015, Congress extended the 30 percent ITC for both commercial and residential solar installations through 2019. In February 2018, the ITC was altered by replacing the requirement to place solar jobs in support by a particular date with a necessity to start building by a particular date. In June 2018, the Internal Revenue Service (IRS) released new guidance to ascertain if construction has started on a solar project. As a result, projects that started construction in 2019 would be eligible for the 30 percent ITC. The credit resigned to 26% for projects that commence construction in 2020 and is set to drop to 22% for projects that start building in 2021 and 10 percent for business projects that commence construction afterwards (eliminated for residential projects). In the event the U.S. ITC continues to scale down as intended, we expect it to act as a notable headwind to need but do note that safe harbor provisions have produced a large pipeline to buffer potential softness. Below a potential Biden presidency, we would

expect an ITC that is likely to freeze at the 22% rate through 2025 (the anticipated ITC degree on the first day of a possible Biden presidency), which is a boon primarily to residential and commercial jobs for a long time to come.

Tariffs

Concerning tariffs, Biden is very likely to be equally as tough on China as Trump continues to be. In January 2018, President Trump enforced a 30% tariff on most of silicon solar cells and modules made out the U.S.. The tariffs decline over five percentage points in each of the following three years (suggests a 20% reduction in 2020 and 15% for 2021). We notice that the first 2.5 gigawatts of sterile cells have been excluded, which may help support some module manufacturing by Chinese gamers as they seem to bypass tariffs. However, the potency of the tariffs started to dissipate in 2019 because of strong demand from the U.S. solar marketplace and an exemption which has been given for bifacial solar modules. The Section 201 tariffs are currently scheduled to stage out on February 7, 2022. We note that former President Obama/Vice President Biden were also strict with solar tariffs on goods that came from Asia so we see no reason why Biden would do an about face. As a result, we anticipate Biden to put the following round of tariffs for the solar industry in 2022. That said, we continue to feel that tariffs have limited influence on job development whilst also increasing the overall cost of solar installations.

Better Certainty Over Tax Equity Obligations

While a significant solar provider,

First Solar, has highlighted that tax equity and equity markets appear intact for high-quality 2020 projects, we believe tax equity obligations for jobs set to achieve commercial operation in 2021 appear uncertain. Covid-19 has led to a number of financial institutions booking record allowances for credit losses lately, citing a substantial uncertainty around the route of recovery. This decrease in profitability may reduce the accessibility of 2021 tax fairness capacity or negatively impact its pricing and provisions. That said, we anticipate visibility into the 2021 tax equity market to continue to improve as economic conditions recover. Separately,” Biden is looking to increase the corporate tax return to 28 percent from 21 percent, which would raise the value of solar tax credits and probably increase the pool of the tax equity financing marketplace. While the timing of Biden’s tax objectives remains an unknown, we believe it’d likely come inside the initial couple of years of his possible presidency. Immediate pay provisions could become reality. While demand for solar has seen a notable increase since April, uncertainty surrounding tax equity availability for large scale jobs scheduled in 2021 and beyond is hurting getting financing on deals.

Getting Funding to Projects

Until now, Congress has been unable to pass a legislative solution that would provide the capacity to receive direct cash payments in place of direct investment tax credits. However, using a potential Biden presidency, we predict Congress would be able to pass a bill that would allow programmers to receive direct cash payments, which would significantly enhance the cash flow dynamics of projects and may encourage greater bookings chances for suppliers such as

SunPower and

First Solar. Meanwhile, we anticipate the current uncertain tax equity setting to delay finalizing some big deals before 2021.

Paris Climate Accord

Biden is likely to put the U.S. back in the

Paris Climate Accord. The Obama-Biden Administration was quite effective, in our view, in supporting new renewable efforts and putting constraints on carbon contamination. In 2015 (signed in 2016), the former government helped embrace the Paris Deal (total of 197 countries participate), with the intent to mitigate greenhouse gas emissions. Under the Paris Agreement, each country must determine, strategy, and regularly report on the contribution that it undertakes to mitigate global warming. Under the agreement, the earliest effective date of withdrawal to the U.S. is November 2020, soon prior to the conclusion of Trump’s first term.