Deloitte’s US Renewable Energy practice helps energy clients address critical challenges and execute initiatives designed to further their strategic objectives, delivering value for their investors.

Consolidating the U.S. Residential Solar Installer Market

A gameplan for industry stakeholders to enter, expand, or prepare for a wind-down as the industry structurally changes.

Tactical Advice for Companies, Strategic, and Financial Investors: Summary

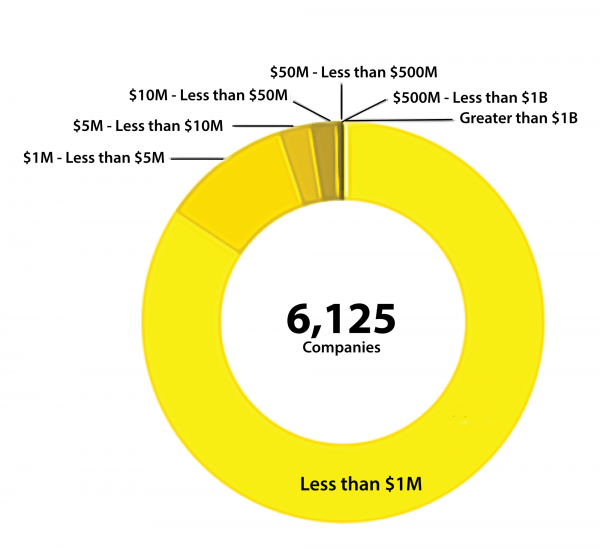

The US residential solar installation industry is fragmented with over 6,000 solar installers in the US. Mega-mergers like Sunrun & Vivint are signaling a significant opportunity for financial and strategic investors to buy or build a competitor.

We bring in experts in the space to break down how to lead the pack before getting left behind.

1.

The Industry is Fragmented

The residential solar market is divided by many small players owning a slim margin of the market and a few large players owning a big chunk of the market.

As solar becomes more attractive and realistic for the residential market, these small installers should see short- term success. However, will experience more pressure from larger players in the long run.

2.

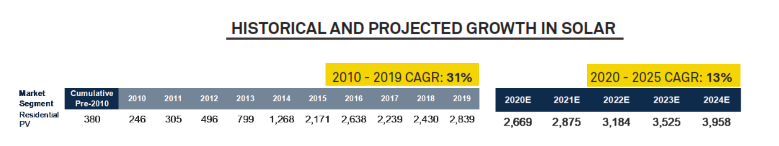

The Market is Reaching Maturation

In legacy states: California, Arizona, Massachusetts, New York, New Jersey, and Maryland, the residential solar market is relatively mature.

But a growing number of states with emerging markets continue to scale and contribute to US residential solar growth.

3.

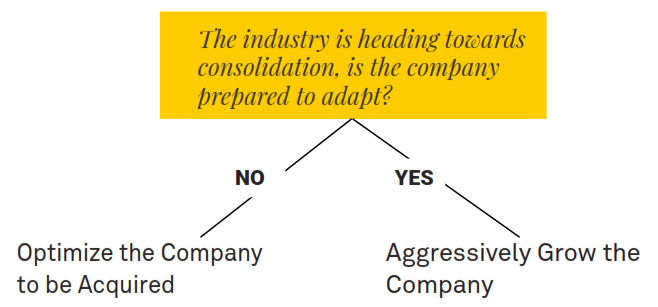

Companies Need to Decide Whether to Grow or be Acquired

In this consolidation, there will be winners and losers, small and medium sized firms need to take a close look in the mirror and ask this question:

“Are we ready to be agile, and grow quickly?”, if the answer is “No” consider preparing the company for a sale.

4.

Opportunity for Financial Firms to Consolidate or Support Consolidators

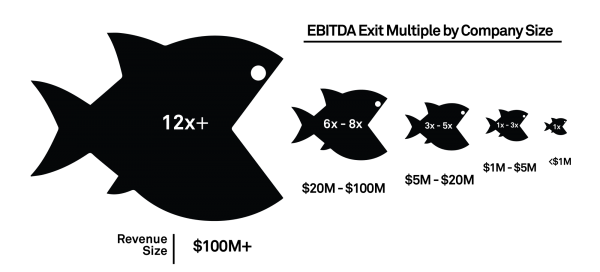

Finding or building the right platform is key to the building value. Size is the driving factor for valuation, with significant premiums paid for companies that get to $20M+ in revenue.

- Smooth, simple sales process

- Integrated digital technologies

- Loyal user base

- Cost efficiencies