ReVolve Renewable Power Acquires Centrica Business Solutions Mexico to Disrupt the Distributed Generation Market

Aiming to transform from a developer of renewable energy projects to a producer of electricity with recurring revenues and cash flow, ReVolve Renewable Power Corp. (TSXV: REVV) (“ReVolve”) signed the definitive agreement to acquire Centrica Business Solutions Mexico S.A. de C.V. (“CBS Mexico”). Meanwhile, ReVolve signed a financing agreement borrowing C$1.6 million from RE Royalties Ltd (TSXV: RE) to finance the acquisition.

Acquisition Details

At the end of May, a definitive agreement was signed by ReVolve Renewable Power to purchase 100% share capital of Centrica Business Solutions Mexico. The acquisition costs MX$ 33,000,000, includes six operational rooftop solar projects and one operational combined heat & power project with a combined capacity of 2.85MW. Beyond that, a construction project of a 3MW combined heat and power project was also included.

Financing

RE Royalties provides C$1.6 million in secured loans to support Revolver’s acquisition of CBS Mexico. The loan will have a term of 24 months and bear interest at the rate of 10% per annum, compounded monthly, and payable quarterly. The company will receive a structuring fee of 1.5% on the loan value at closing and an additional fee of 1.5% on the loan value at the end of the term. The company will also receive a gross revenue royalty of 5% on four of the projects and 1% on two of the projects for the remaining life of the PPAs.

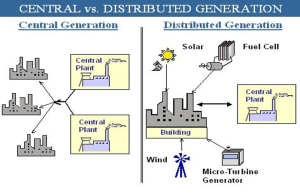

Enter the Distributed Generation Market

Distributed generation refers to the technology of generating electricity near areas where it is used, such as rooftop solar projects from the acquisition of CBS Mexico. ReVolve has been assessing and reviewing potential opportunities in the distributed generation market for several years. Once the acquisition is completed, ongoing projects and recurring revenue will be added to ReVolve Renewable Business Solutions, which is the company’s distributed generation division and was established on April 26, 2022. This transaction supports the company’s strategy to enter the distributed generation market and provides a strong platform for developing this strategy.

Produce Recurring Revenue

The operations included in this acquisition were sold to industrial clients through fixed price power purchase agreements. Therefore, six operational rooftop solar projects and one operational combined heat & power project generate revenues and EBITDA over US$400,000 and US$300,000 per year, respectively. In addition to this, the acquisition includes an almost completed combined heat and power construction project. After this project is implemented, it will also be sold to the company in the form of fixed price power purchases to create regular income. So, the acquisition supported ReVolve’s transformation from a developer of renewable energy projects to a producer of electricity with recurring revenues and cash flow.

Similar Transactions

In late April, renewable energy and sustainable solutions provider SinglePoint Inc. announced the acquisition of Boston Solar Company, LLC, a leading solar installer in Massachusetts. This acquisition helps SinglePoint expand the scope of its solar services operations, meet the growing demand for distributed generation, increase revenue, and drive significant future growth for SinglePoint. The acquisition is very similar to ReVolve’s deal which are both well-positioned to take advantage of the increased demand for distributed generation and get revenue.