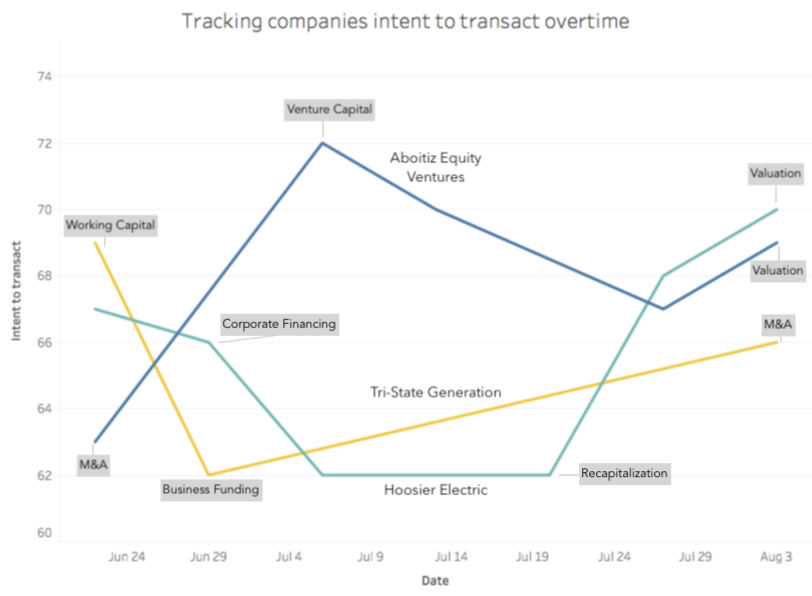

Over the last six weeks, we have been highlighed 10 companies each week that have a high likelihood of being “in-market” for a transaction. This week, we did not unravel new deal flow and, therefore, are re-highlighting three companies on our watchlist that have actively signaled our model. We track these signals overtime and reveal them here.

Pay close attention to the “Keywords of Interest” – these are terms the company is actively searching at 2x – 3x their normal baseline rate.

Previous Predictive Deal Issues:

Week of July 31, 2020 Week of July 24, 2020 Week of July 17, 2020 Week of June 29, 2020

Hoosier Energy

Bloomington, Indiana, United States

Company Summary

Hoosier Energy is a generation and transmission electric cooperative providing wholesale power and services to member distribution cooperatives. Their portfolio includes coal, natural gas and renewable energy resources that deliver power through a nearly 1,700-mile transmission network.

| Key Data Points | |

|---|---|

| Founded | 1949 |

| Headcount | 145 |

| Funding to Date | N/A |

| Last Round | N/A |

| Last Round of Investors | N/A |

| Estimated Revenue | $5M |

| CEO | Donna Walker |

Intent to Transact Score

Keywords of Interest

Ancillary Signals

Our Take

Hoosier is going green and they are likely looking to liquidate their coal assets. A valuation firm will likely be engaged to value the coal assets before sell. They may be seeking investors to buy these retiring assets, but not likely a VC firm.

Hoosier could be reaching out to VCs to build an expert network. Considering how coal heavy the portfolio is, the management team will have to act quickly and accurately to meet its 10 year goals. Bringing in new board members from VC shops could be a strategy to guide the overall thesis of building a gas and renewables focused portfolio of power generating assets.Potential Mandates

- For Venture Funds: VC partners to join the advisory board of Hoosier

- For I-Bankers/Valuation shops: Valuation services and potential advisory in selling coal assets or buying/financing renewable/gas assets

- Strategics: Could be open to a strategic public/private partnership to develop a renewable, reliable, cost-effective grid for the local area of Bloomington

Aboitiz Equity Ventures, Inc.

Metro Manila, Philippines

Company Summary

Aboitiz Equity Ventures (PSE: AEV), fka Cebu Pan Asian Holdings, is the public holding and management company of the Aboitiz Group of Companies. AEV’s core businesses, conducted through various subsidiaries and affiliates, are grouped into five main categories: power distribution, generation and retail electricity supply; financial services; food manufacturing; real estate; and infrastructure.

| Key Data Points | |

|---|---|

| Founded | 1989 |

| Headcount | 267 |

| Funding to Date | NA |

| Last Round | NA |

| Last Round of Investors | Subsidiary of Aboitiz Group |

| Estimated Revenue | $524.3M |

| CEO | Clarice Uvas Marucut (VP) |

Intent to Transact Score

Keywords of Interest

Ancillary Signals

Our Take

AEV has a number of non-energy holdings, so a potential deal could be in regards to another industry, like transportation. Two ways a deal could be done: 1. Contingent on their available funds, they could be in deal sourcing mode. 2. Contingent on the status of their holdings, they could be looking to exit one/some of their portfolio companies. If they were to invest, they’d likely support a company that has already secured seed funding from an Angel.

Potential Mandates

- For Venture Funds: Potential exit of early stage investment to AEV

- For I-Bankers: Potential Advisory work in M&A/exit of portfolio company

- Strategics: Could be open to a strategicinvestments that would support the overall Aboitiz business

Tri-State Generation

Westminster, Colorado, United States

Company Summary

Tri-State, a not-for-profit, wholesale power supplier to 43 electric cooperatives and districts across the Western U.S. They power more than one million energy consumers in Colorado, Nebraska, New Mexico, and Wyoming.

| Key Data Points | |

|---|---|

| Founded | 1952 |

| Headcount | 865 |

| Funding to Date | NA |

| Last Round | NA |

| Last Round of Investors | NA |

| Estimated Revenue | $1.4B |

| CEO | Duane Highley |

Intent to Transact Score

Keywords of Interest

Ancillary Signals

Our Take

Tri-State needs to sustain itself as its business model is tested. In the midst of an energy transition, the historical co-op has faced pressure from the Colorado Public Utilities Commission and may suffer increased costs of $1B. The company has had a streak of losing contracts and Duane Highley, whose been leading for the past year, hasn’t been able to bring much change. Finally, the company is looking to rid some of its older O&G assets to reinvest in renewables, specifically hydro (very costly).

This brings no surprise that as the company scrambles, it’s looking for a wide variety of deal opportunities to bring in cash. They are likely looking for investors to buy some of their assets (retired or those in markets they no longer serve) or they may be looking at M&A opportunities to keep the company afloat. Keywords such as recapitalization and corporate financing are big signals that the company has a weak balance sheet.Potential Mandates

- For Venture Funds: Potential acquisition of energy generation assets

- For I-Bankers: Potential Advisory work in M&A or capital raise

- Strategics: Could be open to strategic investment from other private, larger utilities that are serving their geographic market