Innovative solar cell technologies startup, mPower Technology, today announced that it has raised $2.5 million in Series A financing from seasoned industry investors, such as Santa Fe-based Sun Mountain Capital. The capital builds upon a $500,000 investment from Sandia National Laboratories and will be utilized to commercialize mPower’s breakthrough solar cell technology, DragonSCALEsTM, in the aerospace market.

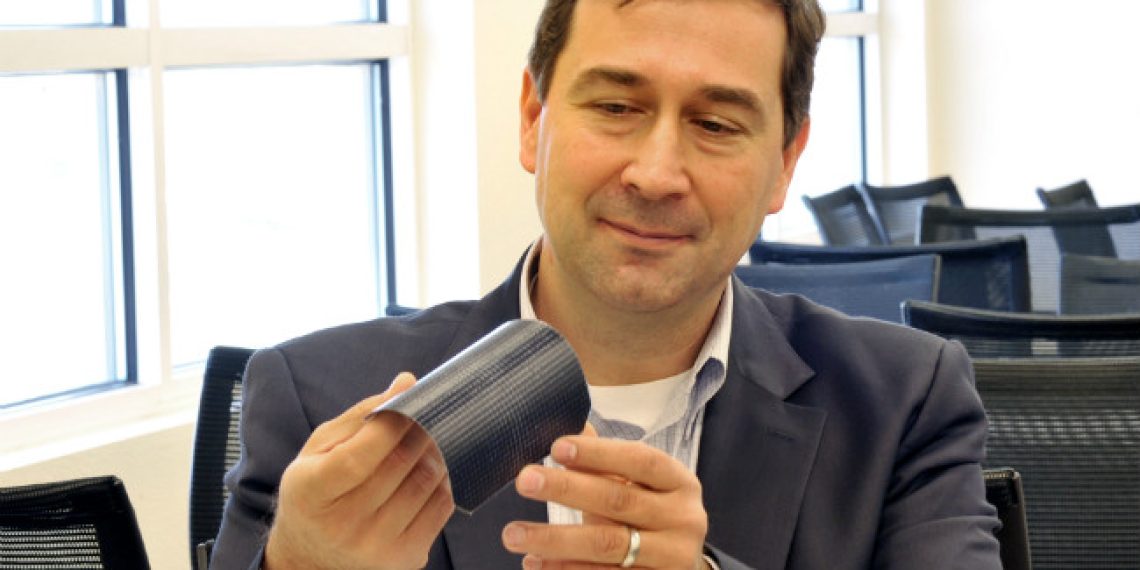

MPower’s DragonSCALEs are made up of individually interconnected cells of silicon that can be meshed into any shape or form. They are lightweight, flexible, resilient and incredibly reliable, overcoming the low-voltage limitations of today’s rigid solar cells. The combined advantages of DragonSCALEs enable a large new range of solar power design possibilities for several applications and markets. In particular, they are an ideal answer for the aerospace market, offering reduced weight and stowage volume, increased radiation recovery, and dramatically lower price as compared to present Gallium Arsenide-based (III-V) alternatives.

“We’ve made a great deal of advancement in 2019 together with our partners in the aerospace market. “With its disruptive cost and performance advantages, our groundbreaking technology is well positioned to be the solar power option of choice for the next era of aerospace applications, particularly the large emerging market for satellite constellations.”

Kevin Hell, president and CEO, mPower Technology.Â

Drawn from the significant opportunities in the aerospace market initially, but also by the expanded market opportunity for applications such as remote power, IoT and terrestrial rooftops, investors think mPower’s technology overcomes critical limitations of present solar cell technology.

“This technology is going to drive the next adoption wave of solar power, we have already seen the advantages that mPower can deliver from the aerospace market and believe that this is simply the start of adoption across many businesses. The team’s strong leadership and vision for growth make this a compelling investment.”

Lee Rand, Partner, Sun Mountain Capital.