About this Industry

Operators in this industry manufacture solar panels and solar cells to supply these products to solar panel installers and downstream residential, commercial and utility customers. This industry does not include solar cells or solar panels manufactured abroad by US companies

Industry at a Glance

Recent trade policies have dramatically reduced imports from China. Tariffs are expected to maintain a substantial effect on the performance of the industry

Industry Performance

The new presidential administration is expected to emphasize the importance of renewable energy, increasing demand for industry products.

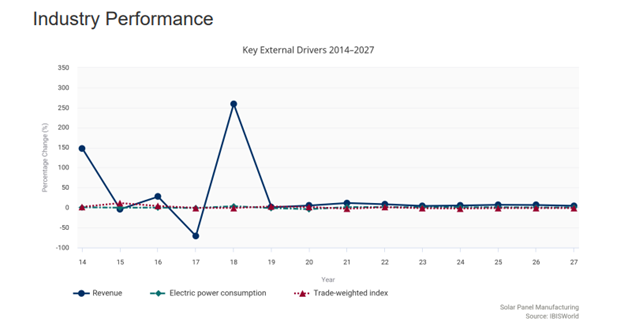

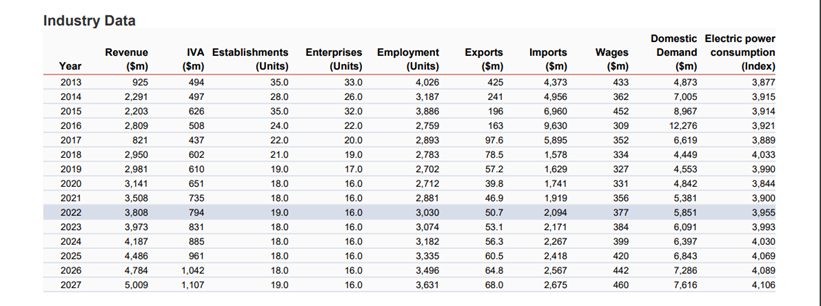

Over the five years to 2022, IBISWorld expects Solar Panel Manufacturing industry revenue to increase at an annualized rate of 35.9% to $3.8 billion, including a growth of 8.5% in 2022.

Products & Markets

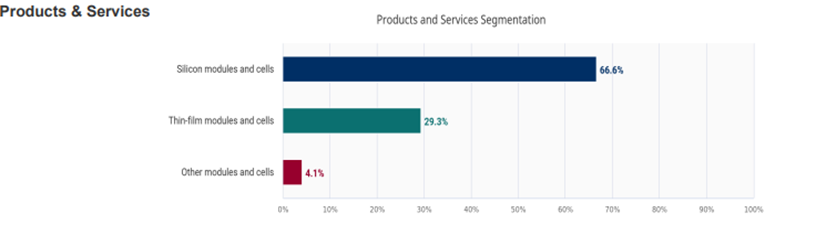

Products in this Solar Panel Manufacturing industry category consist of solar modules and cells made from silicon.

Competitive Landscape

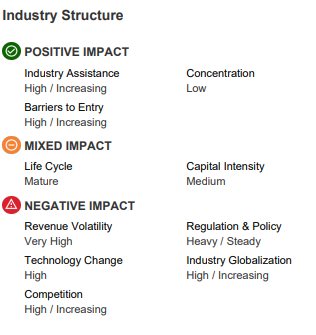

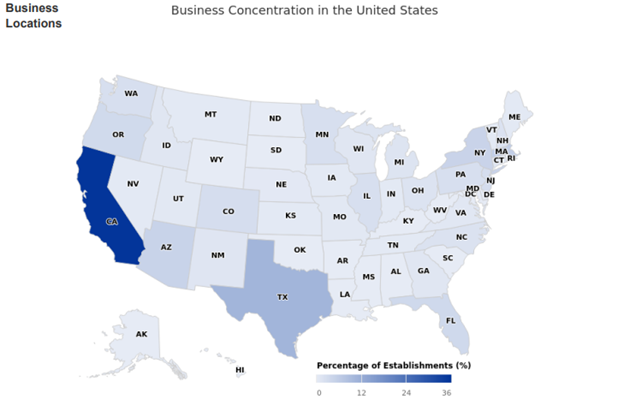

Concentration in this industry is Low.

Major Companies

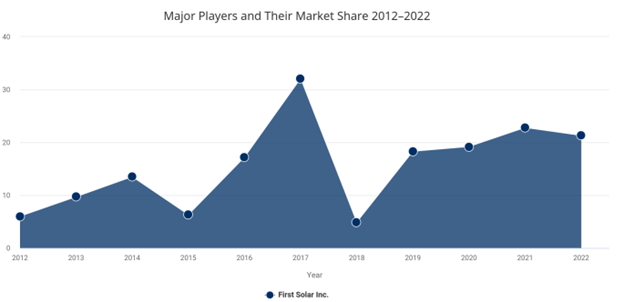

First Solar Inc. Market Share: 21.3%

Key stats 36-37

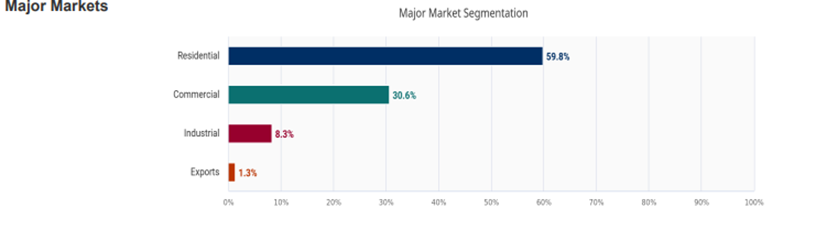

The solar panel manufacturing industry experienced a gain in revenue over the last five years. Over the course of the previous five years, the industry has profited because demand has increased for solar energy. At the beginning of the five-year period, China had dipped into the American market with low-cost solar modules and cells. As tensions grew with China in 2018, tariffs were placed on Chinese companies, giving rise to US manufacturing. Revenue volatility has died down since competition has subsided, and revenue is at a steady pace now. Revenue is expected to increase at a 5.8% rate by 2027 to 5 billion. Crystalline silicon cells and modules are expected to dominate the market due to their high efficiency. The price of these products has come down substantially, leading to a high increase in volume. These products are to account for 66% of revenue for the manufacturing industry. Solar power energy demand is skyrocketing for use by residential, industrial, and commercial buildings because of solar energy’s cost efficiency. Residential will account for 59% of industry revenue, commercial use will account for 30% and industrial will account for 8% of industry revenue. Concentration in the industry is low with tariffs on imports. The keys to success when entering the industry are taking advantage of government subsidies and other grants, developing new products, and complying with environmental regulations. The major manufacturing company in the US is First Solar Inc. First Solar Inc was founded in 1999 and accounts for 21.3% of the market share. First Solar Inc is headquartered in Temple, Arizona, employing more than 6,000 people.

Key Statistics

Key Trends

- Recent trade policies have dramatically reduced imports from China

- International trade is expected to recover following the reopening of the economy

- The reopening of the economy in 2021 should boost industry profitability

- Tariffs are expected to maintain a substantial effect on the performance of the industry

- Although imports are expected to increase, they are not likely to fully replace domestic production

- The number of industry operators is anticipated to rise over the five years to 2026

- Political dynamics have supported existing operators, although profit is expected to fall temporarily

Key External Drivers

Electric Power Consumption

Electric power consumption growth dictates the expansion of utility generation. Greater utility capacity increases demand for energy, including solar power. Therefore, higher demand for solar energy results in a greater need for the solar panels manufactured by Solar Panel Manufacturing industry operators. Electric power consumption is expected to increase in 2022, posing a potential opportunity for the industry.

Trade-Weighted Index

The trade-weighted index (TWI) measures the strength of the US dollar relative to the currencies of its major trading partners. A higher TWI means that the dollar appreciates in value compared with other currencies. Ultimately, the appreciation of the dollar hurts industry exports and increases the cost advantage of imports, lowering industry revenue. The TWI is expected to incline in 2022.

Price of Natural Gas

When the price of natural gas is low, using natural gas as an energy source becomes less expensive. As natural gas becomes a less-expensive energy alternative, demand for the Solar Panel Manufacturing industry decreases. This decline in solar power production reduces demand for solar panels manufactured by industry operators. The price of natural gas is expected to decrease in 2022, presenting a potential threat for the industry.

World Price of Steaming Coal

Steaming coal is used for electricity generation. The higher the price of steaming coal, the more likely that electricity generation companies will turn to alternative sources of electricity, such as solar power. Higher steaming coal prices indirectly raise demand for solar power and increase the need for solar panels manufactured by this industry. The world price of steaming coal is expected to decrease in 2022.

Products & Markets

Geographic locations