The ITC rate will drop from 30% to 10% for commercial, and be completely eliminated for residential solar systems over the next 4 years. While it seems likely the industry will get some legislative relief, we should expect a bumpy rode. Here’s our take.

The drop in equipment costs has created a cutthroat, commoditized market for the small players in solar tech. The coming stepdown in the Federal Investment Tax Credits (ITC) is going to make this volatile market even shakier. The smart angel investor needs to thoroughly consider the impact of the ITC’s phaseout before they make an investment decision. The best decision depends on the regional competitive landscape and solar incentives.

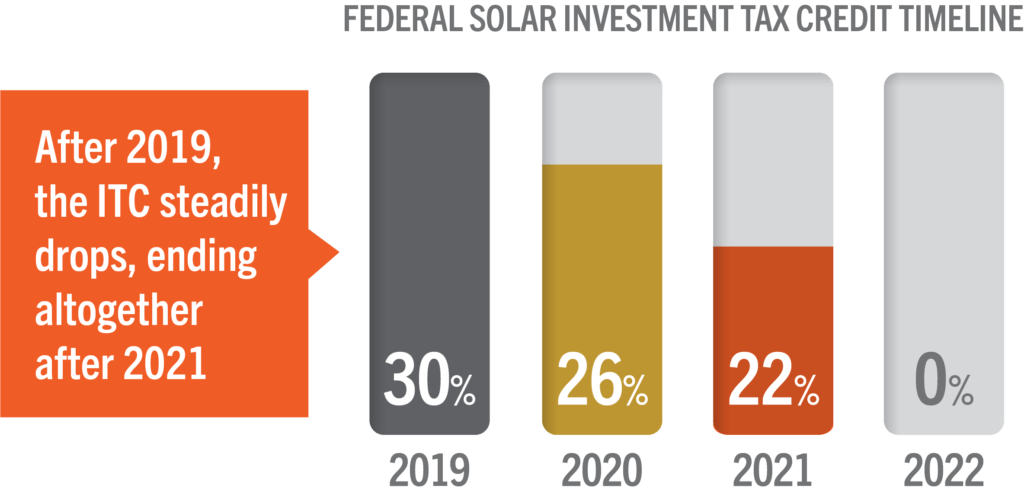

A Quick Recap of the Step-down

The ITC will drop from 30% to 26% in 2020 for commercial and residential systems. 2021 will bring a reduction to 22%. From 2022 onward, a 10% credit will benefit the commercial industry, while the residential industry will have no tax credit. Legislators and industry groups are lobbying for another industry extension, but analysts are not optimistic about the outcome.

Where to Invest?

Markets like Delaware already provide razor-thin profit margins due to low state incentives. These states are not the right place to create a brand new company or test an early-stage innovation. The silver lining is that a handful of top players will survive to become market leaders.

When evaluating companies in low ROI states, focus on the leading early-stage companies with strong financials and strong brand value. Well known, low debt companies have the best chance of surviving when their margins become even thinner. These companies will emerge with a stronger and stabler market share than companies in higher ROI states.

States with high utility prices and high state incentives provide thriving solar markets with good margins. These are New Jersey, New York, Vermont, Massachusetts, Rhode Island, Missouri, and Colorado.

The downside is that the prosperous environment breeds stiff competition. In less saturated state markets, the typical consumer can name one or two solar providers. Competitive markets give consumers dozens of quality options with little differentiation. Many companies find themselves in a race to the bottom with price as.

The upside is that if you are looking to invest in a company with a unique value proposition or a new technology, these markets give an upstart a better chance to survive and thrive. Higher profits mean that companies can take longer to find their footing. And, if the company has a truly unique marketing angle or value proposition, they will stand out from the sea of identical competition.

Action Plan: It Depends on Your Appetite for Risk

The ITC phaseout means that the market will get even more competitive. Consolidation is coming and clear market winners will emerge. Ultimately, appetite for risk and investment interest will determine the right decision.

Later Stage, Lower Risk Investors: Fund the strongest companies in the tightest markets, they are going to need additional capital to ride out the wave and consolidate regional markets.

Earlier Stage, Higher Risk Investors: The markets with the highest state credits and highest utility markets will provide the best opportunities.

Sign Up for Investors

Solar Power Investor offers three levels of membership for the investment community: standard, premium and custom with the goal of providing insight, news at our standard offering, actionable deal opportunities for premium members based on criterion and mandate, and a custom offering where we can guide larger investment thesis and approach.

We are in a unique position to see a lot of companies and activity, some actively looking for a transaction partner, some of who we believe would be a good candidate for a transaction. We never make more than 5 introductions per company, and so actionable opportunities are not part of a large auction process and typically “off marketâ€.