With technology coming out of CalTech, company attacks critical problem of panel efficiency that industry insiders recognize, hard for traditional angel / vc market to understand.

ETC, originally from California, just raised $2.7M from E.U Horizon 2020 fund following a $150,000 seed round from CALSEED a year ago.

The technology, which has been marketed by a new startup company–ETC Solar, LLC–could potentially improve the output of solar panels about 5 per cent, regardless of the type of photovoltaic material used to make the panels.

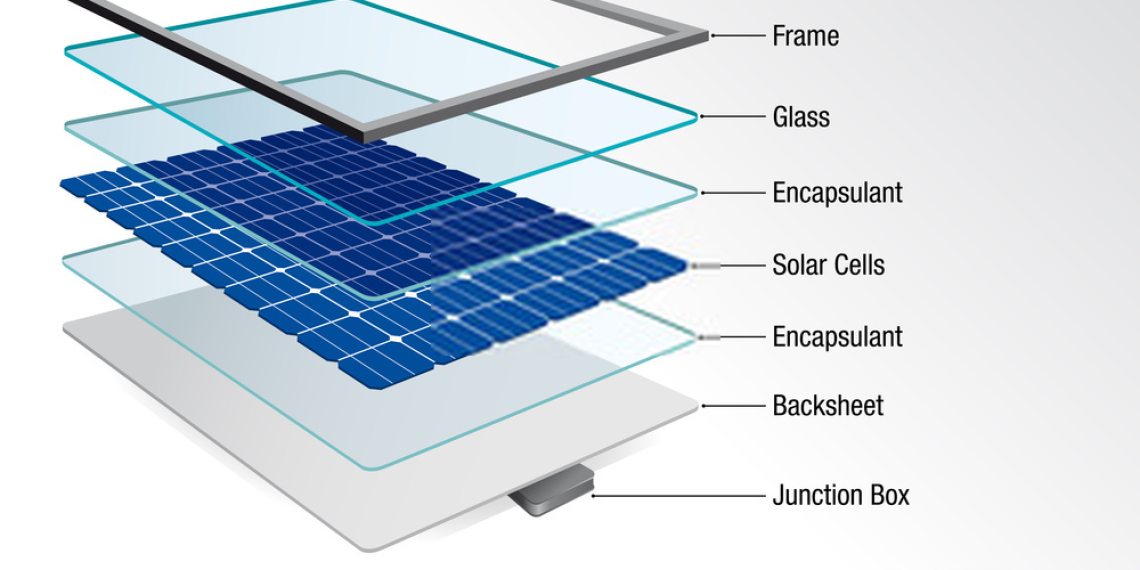

When sunlight strikes solar cells, then it excites electrons in the cells which are then collected by means of a grid of metal filaments. This grid is printed in addition to the solar cells, much like the circuits onto a circuit board. Tiny although the filaments might be, they do cast a shadow on the face of the solar cell, and this shadow lessens the overall efficiency with which the mobile produces energy. ETC’s design uses metal filaments that have a triangular-shaped cross-section, like a steep A-frame house roof. Instead of casting a shadow onto the face of the solar panel, the filaments reflect light toward the surface.

The ETCs, that measure about 15 microns large, are made by direct-etching grooves to a silicon wafer. The wafer can be used to fabricate a mould that is placed onto a solar panel, and the grooves are subsequently full of a conductive ink. When the ink heals, the mould could be peeled away, leaving the silver ETCs behind.

Throughout the I-Corps program, representatives from ETC Solar traveled around the world, running 150 interviews with prospective customers like solar-cell manufacturers about the commercial needs of the solar-cell market. Those interviews revealed that the biggest problems faced by manufacturers relate to efficiency and price, since the market has extremely tight profit margins and is pushed by market-share expansion.