Nuveen, the $1 trillion worldwide investment manager of TIAA with five decades of expertise in responsible investing, has headed a Series B growth equity round in Advanced Battery Concepts LLC (ABC). ABC develops and licenses technologies linked to bipolar lead-acid battery structure.

ABS has done well raising capital, $15M over 11 rounds since 2011 primarily from The BlueWater Angels, with Nuveen being the first “institutional investor”, which begs the question, what does an exit look like?

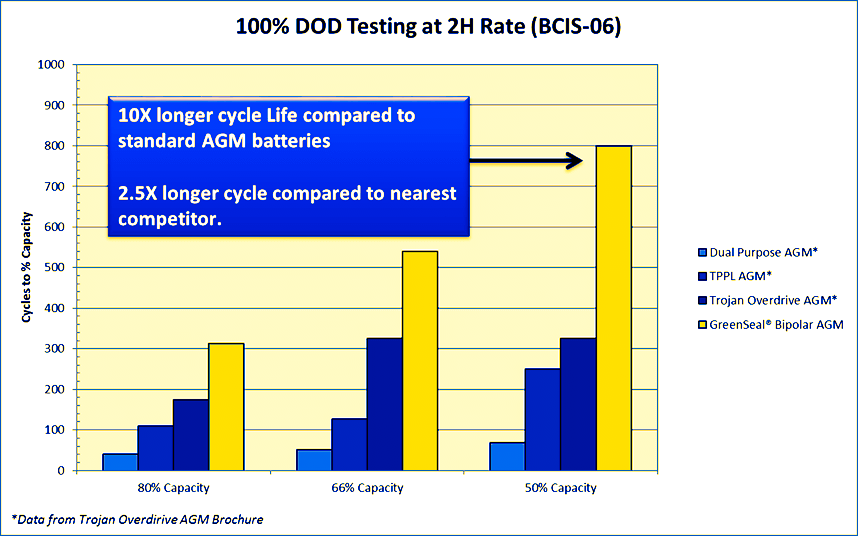

ABS has an interesting story and tech, “We’ve re-invented lead battery technology. GreenSealâ„¢ technology enables improved performance at lower production costs for traditional lead-acid batteries. With extendibility into other advanced chemistries, GreenSeal delivers dramatically better performance than any existing battery technology.” with advances in bipolor battery tech and a large IP portfolio.

The investment was the first against the Nuveen Global Impact Fund, a private equity vehicle created earlier this year to make direct investments worldwide in high growth companies that try to address climate change and bring about inclusive growth. The Fund represents the most recent expansion of Nuveen’s historical private influence investing attempts, through which over $1.0 billion was deployed over the last ten years. The investment in ABC supports the Fund’s focus on companies that enhance resource efficiency.

“If we want to tackle global sustainability challenges like climate change, we need to learn to live within our means. ABC’s technology improves the functionality, cost, and resource strength of lead-acid batteries while still preserving total recyclability. We consider that the lead-acid batteries may play an essential part since electrification continues internationally.”

David Haddad, Co-Head of Nuveen Private Impact Investing.

We are delighted to have gained support from a global investor like Nuveen. Its impact expertise and network will be critical for our next stage of growth, helping us build relationships in new markets and geographies, we look forward to working together to support the world’s energy storage needs.”

Dr. Edward Shaffer, Founder and CEO of Advanced Battery Concepts.