The American solar panel installation market has seen growth aligned with the overall American economy over the last five years. Investors have turned to M&A for geographic expansion as many have made attempts to roll-up regional installation businesses. Solar demand is largely driven by rising electric prices, government spending, and increasing corporate profit. The fragmented installation market can be seen by the current dynamic in market share. Sunrun and SolarCity (Acq. by Tesla) hold ~15% and ~14.4% of the American market, respectively; other regional players makeup the rest of the ~70.6%.

An Expanding Future

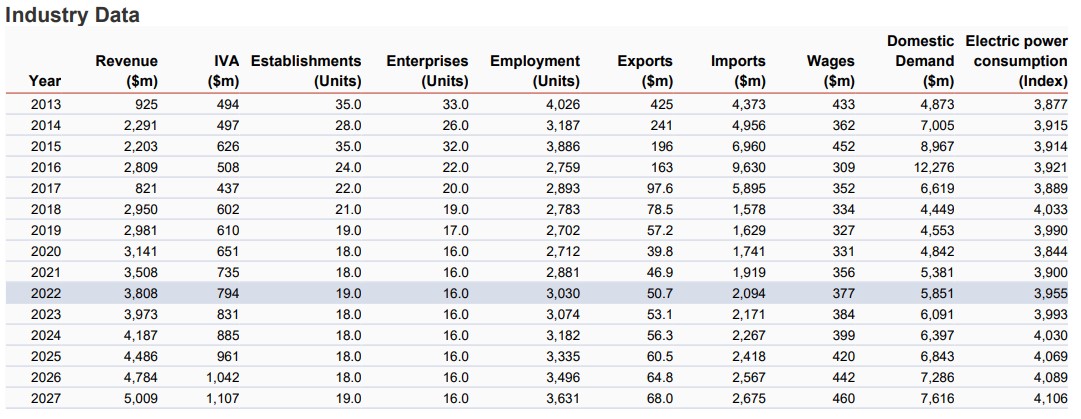

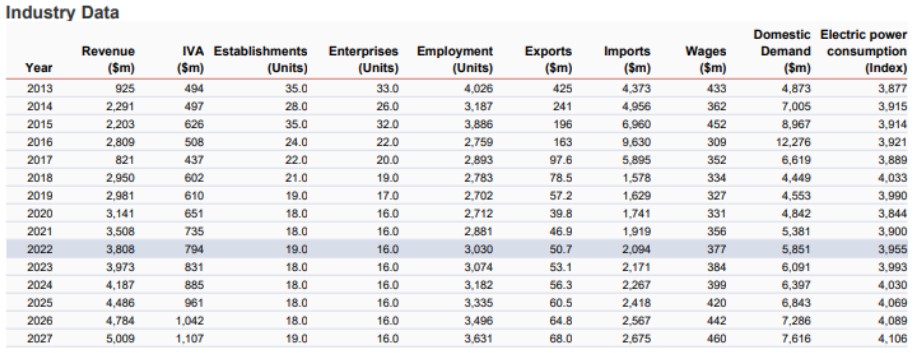

The Solar Panel Installation industry is forecasted to expand over the next five years to 2027 as the economy recovers from the CV-19 pandemic. As energy prices and inflation continue to impact American families, many are turning to renewable energy.

Industry Drivers

- Electric power consumption- Electric consumption has trended upward along with increases in the number of households, manufacturing capacity and industrial production. As consumption increases, prices increase as well, driving customers to alternative providers. Expected to increase in 2022

- Corporate profit- Corporate profit measures the income from all industries. Corporate profit shows the ability to upgrade facilities and invest in new projects. Expected to increase in 2022

- Per capita disposable income- Per capita disposable income shows the amount of capital an individual has to spend in the economy. Solar panel systems are expensive but new financing options are available to make residential use affordable. Per capita disposable income is expected to decrease in 2022.

- Tax credits for energy efficiency- State and federal tax credits have influenced consumers to invest in solar systems. The Energy Improvement and Extension Act of 2008 has been extended to 2023.

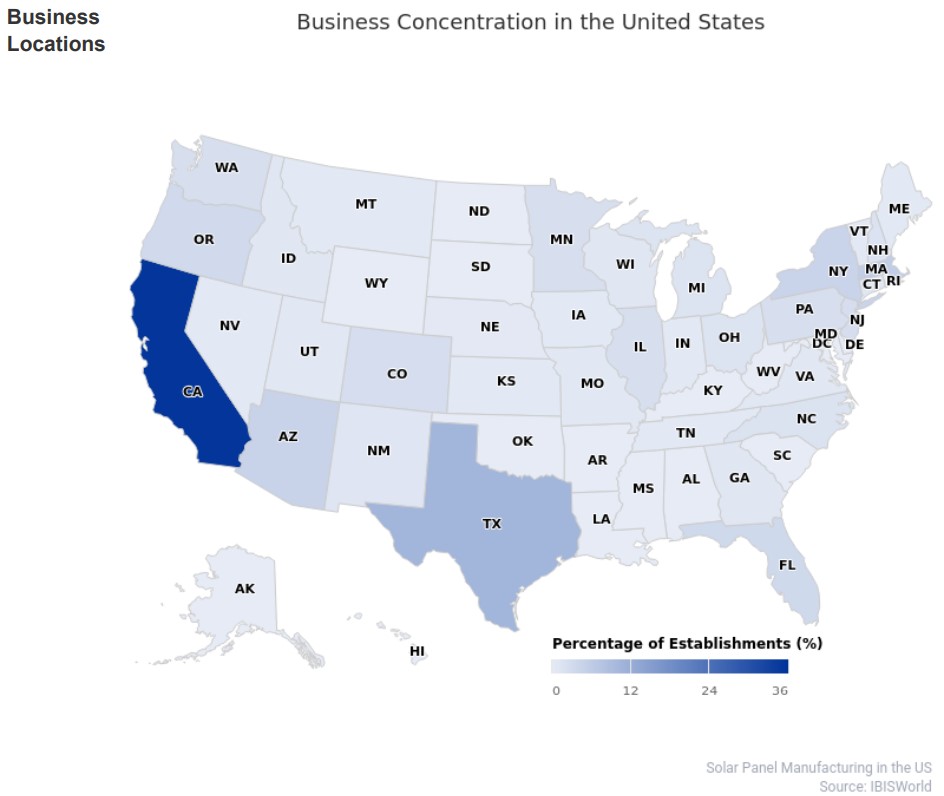

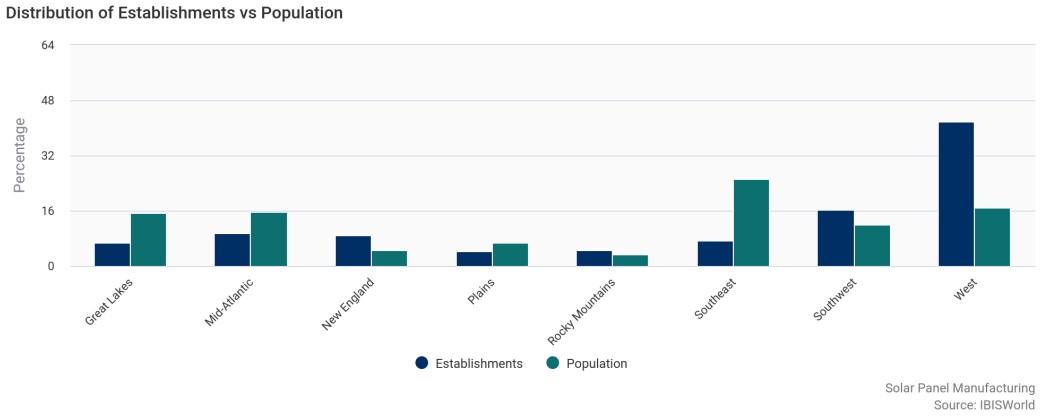

Geographic Analysis

California accounts for ~55% of all solar installation businesses in 2022. The state has many favorable incentives provided at the state, city and county levels. This includes six different state rebate programs.

Synopsis

The American solar market is still recovering from Covid-19 but has many factors showing upside potential. The solar panel installation industry has gained 11.4 billion in revenue in the past five years and is expected to hit 12 billion by 2027. The federal government is helping out many American manufacturers by imposing tariffs on China to help boost manufacturing in America. The new presidential administration has emphasized the importance of renewable energy, increasing the demand for services and products in the industry. More Americans are turning to solar power for cost efficiency with electrical prices increasing. With government subsidies and tax breaks, the solar panel market is getting boosts to grow as Americans put forth the effort and are being assisted in switching to solar energy.

Solar Panel installation has had many tax benefits and boosts from the federal government to carry out their services. The Energy Policy Act of 2005 credits 30% of installation costs to residential and commercial solar power systems. The Energy Policy Act has been extended three times and will expire in 2024, but it will likely be extended again. The tax break has helped balance the high installation costs of solar power systems. There are two types of different solar panel installations that are the most common. Silicone cell-based and thin-film are the most common types of solar panels installed for customers. Silicone cell-based are usually installed for residential customers and have a high conversion rate of energy efficiency. Thin cell-based are installed on top of commercial buildings and take up much more space. Thin cell-based are not as efficient as silicone but are less expensive to install. With the help of government subsidies and financing options offered by the installers, prices have come down for commercial and residential buyers.

Installation Data

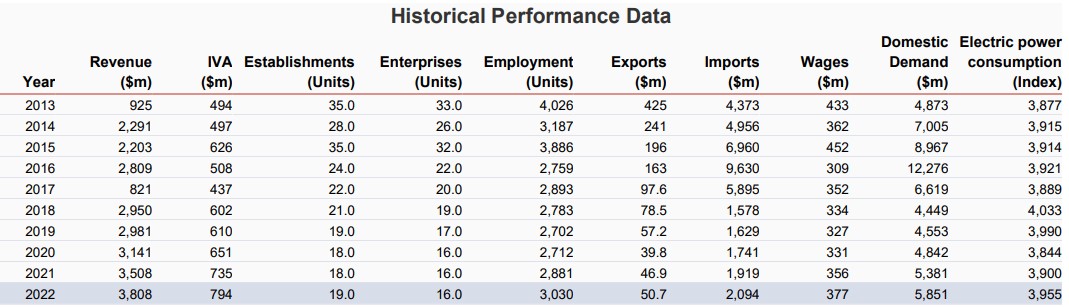

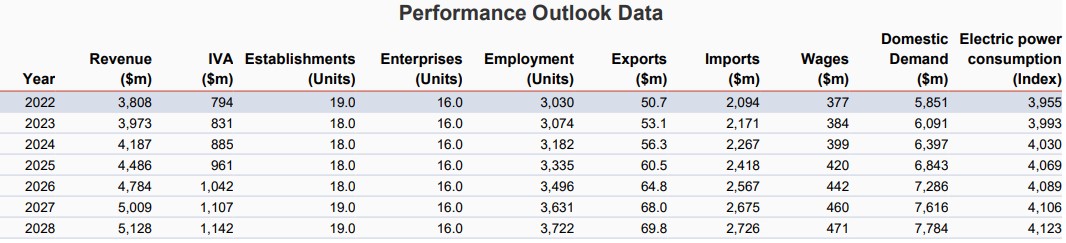

Manufacturing Data

Industry Statistics

- The cumulative capacity of solar power installed in the residential and commercial market has increased more than five-fold between 2000 and 2020.

- As demand grows for the majority of the period, the number of establishments necessary to service this industry is expected to grow at an annualized 2.2% over the five years to 2022, reaching 13,402 locations.

- Industry revenue is expected to increase at an annualized rate of 1.1% to reach $12.0 billion over the five years to 2027.

- In 2022, thin-film solar panel installations are expected to account for 23.4% of industry revenue. The remaining share of industry revenue is expected to account for 7.6%

- The residential construction market continues to account for an estimated 67.9% of total revenue in 2022, aiding industry revenue expansion. (residential vs nonresidential market)