Omnidian, the software startup that features home solar performance ensures, increased a $15 million Series A to expand operations.

The Seattle-based company raised a $5 million seed round in 2017 to sell digitally aided performance guarantees to big residential solar portfolio owners. The new influx of capital will support an aggressive growth to serve individual homeowners via partnerships with vetted installation businesses, CEO Mark Liffmann stated in a meeting.

Omnidian will use the capital to expand into the industrial solar market, and over the long run, to offer O&M services for other home devices. The aspiration to provide value to more verticals shows up in the root of the company name: a mashup of “omnia,” Latin for “everything,” and custodian.

“The simple fact that we depend on homeowners to maintain these complicated assets, whether it’s HVAC or residential , generates an extremely negative customer experience. From the world of [net of things], that doesn’t have to happen any longer.”

– Mark Liffmann, CEO Omnidian

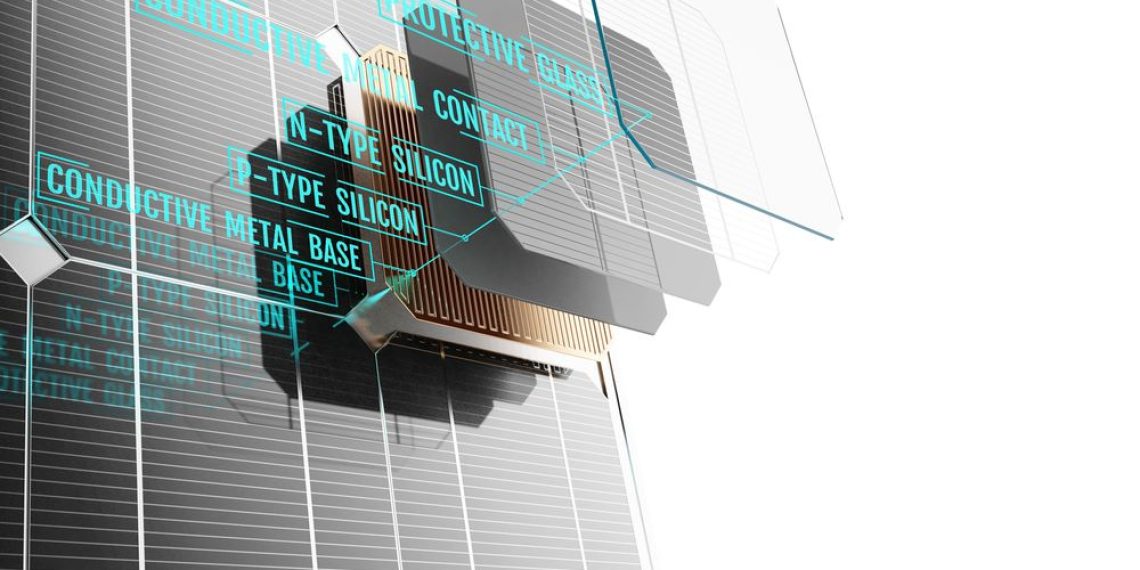

Omnidian brings information from a recently installed solar system’s monitoring devices, combines it with weather and irradiance information, and defines a baseline for anticipated production. Then, the company utilizes machine learning to automate the detection of problems that reduce electricity production, and dispatches outsourced operations teams into the field as necessary.

The person who owns the system gets a performance guarantee that covers fixes and maintenance and is accompanied by an annual tune-up if production falls short of the guaranteed level.

To reach individual homeowners, Omnidian had to enroll as a home warranty provider in every state that it wants to operate in. It’s secured regulatory approval in eight states, including Massachusetts and Arizona, and is finishing up the process in California and New York.

The sales pitch, however, isn’t very different between the two core client groups.

“Homeowners and portfolio owners basically need the exact same thing. They want to get the energy out of their own solar system so that they receive the return on investment that they’re expecting.”

– Mark Liffmann, CEO Omnidian

Omnidian additionally sends quarterly production reports co-branded with the installer partner, giving the solar supplier an additional touchpoint with the client post-installation. Liffmann believes the referral business is the driver for solar companies, and the co-branded reports help them construct that referral business.

The direct-to-consumer vertical tracks consumer preference for money or loan prices.

Lease or PPA systems bundled into a fund have an owner invested in preserving their output and savvy enough to mobilize the required resources. But homeowners who buy their particular system often have little protection against wear and tear beyond the installation warranty, Liffm. As the numbers of self-owned systems increase, so will the demand for maintenance.

A solar trader that wishes to pitch clients on the maintenance package can pay Omnidian $300 to give the homeowners in the first season free, after which they could subscribe for $13 per month or less.

Supplying a solar performance guarantee for customer-owned systems, based on automatic fault detection, represents a brand new addition to the solar O&M market, argues Abe Yokell of Congruent Ventures, the early-stage VC firm that led Omnidian’s seed round.

The startup currently manages approximately 80,000 solar assets and has demonstrated “solid revenue growth” because the seed around, Liffmann explained. Since the company invests in software, rather than hard assets or in-house field support employees, expansion could happen quickly.

“We can scale nearly instantly from the almost hundred thousand assets we manage today to countless resources.”

– Mark Liffmann, CEO Omnidian

At the very least such growth will require expanding the sales team — Omnidian currently has a staff of 35.