Market research firm Wood Mackenzie states PV inverters are close to their ‘end of life’ replacement.

Historically, conventional string inverters ought to have a lifespan of approximately 10 years, while fundamental inverters, used for utility-scale PV electricity plants may undergo major part replacements in half that time period.

Wood Mackenzie explained that total inverter replacement requirements are expected to account for 3.4percent of the international inverter market, heading into 2020, while this could increase to 14% of their total cumulative capacity, within the upcoming following five years.

From 2024, at total of 176GW of all PV systems would have inverters older than ten years using replacement costs approaching US$1.2 billion from a total O&M chance of US$9.4 billion. Present annual O&M plant costs were said to be almost US$4.5 billion.

However, inverter replacement costs represent only 12-13% of the typical O&M price when calculated for 50MW solar grid, according to Wood Mackenzie. Inverter cost reductions and thinner margins for producers are a contributor decreasing inverter replacement costs.

Wood Mackenzie is forecasting the global solar market in 2019 is anticipated to reach a new 114.5GW, an 18% increase from the preceding year, while yearly PV installations are forecasted to leading out from the 120GW into 125GW range through 2024.

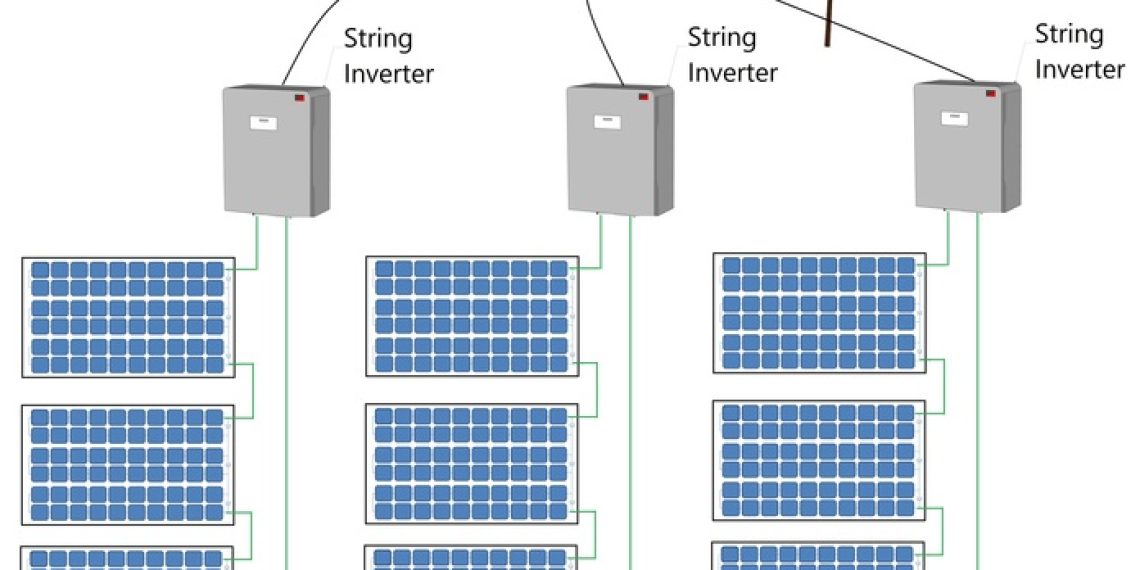

PV installations are forecasted to top out in the 120GW to 125GW range through 2024. Picture: Wood Mackenzie

Presently, public recorded inverter suppliers like Sungrow Power Supply and SMA Solar Technology don’t breakout imports or revenue related to the emerging replacement marketplace.