Key metrics and signs of disaster to avoid at all costs

We welcome Walid Halty from DVINCI that comes armed with data from 4,000 installations over 12 states, 3,500 different cities and 4 years to give us the good, bad, and the ugly.

If you are considering investing in a residential solar company, or acquiring one, here are some key opportunities in the market, and red flags to be aware of:

1. Increasingly High Customer

Acquisition Costs

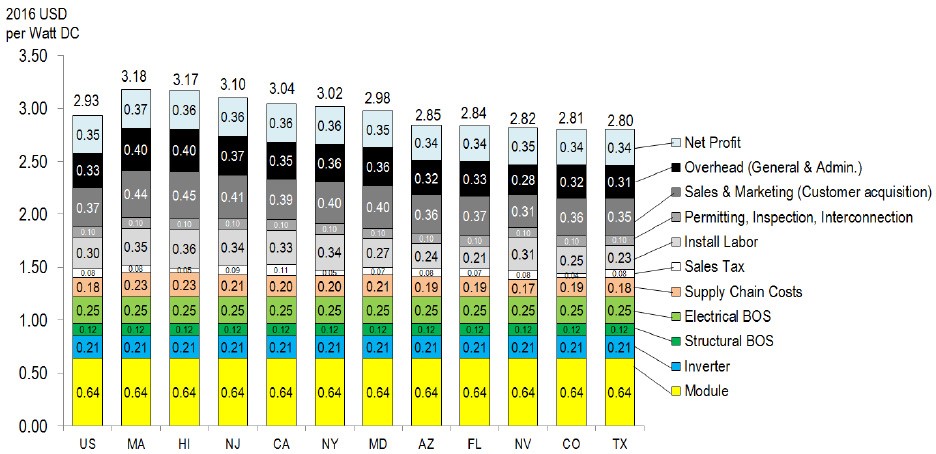

Customer acquisition is the most expensive, if not most important, portion of residential solar, accounting for 23 percent of an average system’s price (per WoodMac data).

Customer acquisition costs in residential solar have grown steadily from $2,870 per customer in 2013 to $3,898+ per customer in 2019.

High cancellation rates are typically not included in the cost of standard customer acquisition.

The average cost of a customer cancellation is $2,500. Moreover, industry cancellation rates are trending in the 50% to 70% range.

There are few companies, like DVINCI, that are able to maintain cancellation rates under 20%. Retaining the cancellation rates on the lower end of the spectrum is a positive factor to look for when examining a company’s customer acquisition numbers.

2. Lack of consumer awareness & trust

Feedback from consumers tells us that companies that are hyper-local seem to have a better response-rate from homeowners. Companies that are successful have good online reviews and provide a seamless customer journey which includes a consistent narrative between sales partner, installer, and homeowner.

Along with a clear narrative, customers want a single point of contact. Homeowners also want concise options that can be expertly explained, Companies that provide continually updated training for their representatives are successful in the customer acquisition and retention process.

Accuracy and timeliness affect efficiency at every stage of the residential solar business. It is crucial that all timelines be measured. Additionally, having too many people involved in the process can create layers of inefficiency. Successful companies deploy technology and automation to systematize their processes, which can eliminate overhead expenses by almost 50%.

While we are all affected by the COVID-19 guidelines, the interface with customers need not be limited. As Sunrun CEO Lynn Jurich states, solar companies that overly rely on selling face to face will have difficulties.

Installers are also having difficulty conducting site surveys and installs. However, the digitizing of as many of the customer interaction processes as possible can provide solar companies with a resilient online platform to successfully accommodate many market changes. Creating such a platform helps solar companies be more aligned with the already evident standards seen throughout the industry today.

Data consistently indicates that customers increase their electrical consumption by 10% – 15% after they adopt solar. Increasing their solar capacity is a high probability outcome. The addition of electric vehicles increases consumption by ~ 50%. Successful companies monitor their customers’ production, and consumption when possible, to project an appropriate upgrade opportunity.

Investors should look for companies that are not only planning for the future but are actively diversifying their portfolio of products and services: these companies will be market leaders in the expanding clean technology sector.

7. Diversify wherever possible.

Many companies have struggled through reliance on a single source for their products and services. That reliance has become a single point of failure. Look to companies that have diversified their portfolios of suppliers, partners, and products, which include lead sources, financing products, installation capabilities, and hardware.

Investors should look for and engage companies whose strategic vision encompasses a focus on efficient and accurate technology and processes that optimize customer acquisition and retention.

Why Walid’s Perspective Matters

As a platform that orchestrates all parts of the residential solar value chain from lead generation to fulfillment, DVINCI engages with millions of homeowners, facilitating thousands of installations through a growing marketplace of countless installers & sales partners in over 12 states. Because of its positioning, DVINCI has a unique vantage point and large amounts first-hand data on what is and isn’t working in the solar industry, especially in the residential segment.

About Walid Halty – See Full Profile Here on SPI

- Named “30 under 30” by EarthX and “40 under 40” by Renewable Energy World

- 6 years of clean energy technology leadership, Serial social impact entrepreneur.

- Former VP at Bright Planet, CRO at SunGrade, Regional Manager at Solar City

About DVINCI

Dvinci Energy was formed in 2016 by an experienced social-impact entrepreneur who conceived of a business-to-business-to-consumer business model that would enable a new era of clean energy entrepreneurs to scale the deployment of clean technology products – such as rooftop solar, community energy, battery storage, and many other energy-efficient IoT products. Dvinci’s cloud-based platform is the first built to leverage the “gig economy” in the cleantech space by allowing any entrepreneur or business to access clean energy products and services.”